Patients First — Build (Part 2)

Succeed in building a focused, full-stack experience that strives for scalability while emphasizing a relationship with the patient.

This was originally published on Medium.

This post is Part 2 of a series. Click for the Overview, Part 1, and Part 3.

Constrain your focus

Own the full value chain

Optimize for scale in tech / processes

Empower a relationship between your product and your patients

Constrain your focus

In his famous series How to Kickstart and Scale a Marketplace Business, Lenny Rachitsky researched 17 of the most notable marketplace companies. He found that:

“with the exception of one company, every single marketplace that I interviewed constrained their initial marketplace”.

“The research points to two ways to constrain a marketplace: (1) by geography, and (2) by category.”

It turns out that this is the case for patient-facing healthcare as well. The connection makes sense — all healthcare products that deliver some form of care are marketplaces, connecting the demand of patients to the supply of care. As such, there’s two general routes for constrained focus: own everything about a given experience and expand geographically, or own one particular patient experience then expand to new categories.

The early focus becomes a superpower — you can fill gaps in the patient journey and create a personal, in-depth patient experience for your specific patient category, or optimize operational efficiency in your select geography, in ways that the incumbent experience never could. Healthcare isn’t one size fits all, rather quite the opposite.

Capsule

Capsule initially served New York City in 2016, minus Staten Island, and took +4 years to announce launches in new markets.

“We’ve spent, you know, five years in New York building the operational and technological capabilities, expertise to be able to scale the business really rapidly until we were able to turn that on pretty quickly.” — Kinariwala

Maven

Though providing access to a variety of women’s health care providers from early on, Maven dialed in on the category of the fertility experience — prenatal and postpartum care — and identified on-demand access to information and care at this point as the core focus.

Oscar

After launching in New York in 2014 and briefly expanding, Oscar notably constrained focus further and halved its New York footprint, citing curation of its provider network as core to its strategy. Although it faced initial criticism, it paid off a year later in profits and in patient experience.

“In a system where every network is broad, where insurance largely gets sold through big employers, where there’s a big incentive to keep everybody in the network, where there isn’t the kind of competitive pressure on the value chain, there isn’t that much of a reason to develop a better correlation between cost and outcomes, or even visibility into how certain parts of the system perform.” — Schlosser

Ro

Ro started out with a vision for men’s health, but focused down to ED, citing reasons of personal experience, stigma-created opportunity, and ED’s ties to deeper health issues.

“The problem was we didn’t know where to start. We knew we couldn’t tackle all of Men’s Health from Day 1. We have all started companies before and know that maniacal focus is vital to success. We would never make it to point C if we didn’t first go from point A to point B. The day after my being told I needed medicine again, Saman, Rob, and I were jamming. I brought up the idea of starting our men’s health company with ED.” — Reitano.

Trialspark

Trialspark originally started as purely a clinical trial recruitment product.

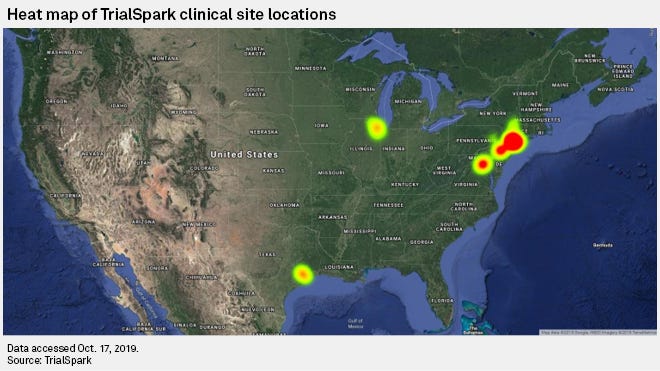

The company creates geographical focus by utilizing de-identified patient data sets to identify geographic markets that are “high-potential ‘hot spots’ of potential trial participants” — this was the approach since its launch with New York sites for ankylosing spondylitis partnering with Novartis. Sites are established based on logistical complexity, potential patient identification, and sponsor requirements, among others.

Cedar

**The marketplace analogy applies less to companies like Cedar as it deals less with care and more purely on the patient experience, but the importance of constrained focus remains.

“When we first started out, like most companies, you’re extremely narrowly focused on solving the one very micro problem. So for us, it was figure out how we can basically replace paper statements with a much better process after a patient has had a visit. Today, if you look at what Cedar does, we still do that. That’s the core of our business. But we’ve now expanded our vision.” — Arel Lidow, Co-Founder / President

Own the full value chain

“There are all kinds of middlemen in that process. And what the middlemen do for the most part is remove the competition in the health care value chain that would go towards building something that’s a compelling, seamless user experience. They remove the cost-containment pressures as well. That’s one big reason why health costs in the US have risen so much.” — Schlosser

With your focus constrained, the key priority is to own all the problems concerning the area of focus. In essence, all the problems that prevent the patient from accomplishing their end goal, which is why they came to you in the first place — from where your patient meets you, to when you deliver value to your patient. Patients need healthcare to be convenient, affordable, outcome-driven, and personal, and your end product isn’t valuable until it creates such an experience.

This means owning the entire value chain (within reason). You can’t build the experience you want and your parents need plugging into incumbent systems. Through this, you disintermediate middlemen, take ownership of the experience, and use holistic data insights & product design to improve the existing points in the patient journey AND gaps between points. This is how you can actively target embedded complexities, costs, and inefficiencies/poor outcomes for the patient. This is the foundation that enables you to scale.

Complexity: Ingest navigational complexity of the existing experience for patients, surface something actionable.

Cost: Operational efficiency (reduced SG&A) + improvements in unit economics over time mean you can pass on cost savings to patients. Also, the more

Inefficiency/Outcome: End-to-end data ownership empowers the promise of digital health — enabling the right action for the right person at the right time.

“We wanted to be the company that takes on the complexity, so our members never have to. We wanted to not only offer the best experience in the present but innovate on the future.” — Reitano

Of course, full-stack ownership is no small feat. The larger the scope of ownership, the larger the need for capital. Clarity of vision becomes all the more crucial as your company starts to seek investors to fill that need for capital.

To mitigate that challenge, the companies of this post have all started with an end-to-end vision, but took a gradual approach, initially only building the very core of their value prop to their patient, and either outsourcing or backlogging the remaining parts of the end-to-end experience.

Capsule

“If you think about what you need to get started in this business, you need to build a pharmacy. You need to sign a lease, and you need to construct your pharmacy, and you need to buy drugs, and you need to have inventory, you need to hire people, you need to build a brand. So, I had raised the first round concurrently with me really saying, “This is what I’m going to spend the next decade or more of my life doing. So, we had done that in May of ’15. We spent a year building out the rest of the team, the brand, the technology, the regulatory permits, everything. Then we launched the business in May of ’16.” — Kinariwala

“We’ve built a completely proprietary software stack that powers our experience. And that has been a really key differentiator in delivering what is the only true end-to-end modernmobile first ecommerce experience in pharmacy. And nobody else has that where you can end-to-end transact and manage your medications from your phone.” — Kinariwala

Cedar

“But Cedar Pay is just the beginning. To solve the real problems of healthcare delivery costs and pricing transparency, we need to arm patients pre-procedure with the information and self-service they need to avoid the sticker-shock when the medical bill arrives many weeks post-procedure. And Cedar is doing just that, rolling out a full patient engagement platform that will not only make the post-procedure payment process work smoothly, but engage the patient pre-procedure so she understands what she will owe the healthcare provider and can manage her information-exchange digitally.” — Scott Kupor, a16z GP / Cedar Board

“We have to build a secure, scalable data pipeline from a myriad of complex data sources. We have to continuously synchronize patient data from multiple clients’ EHRs (Electronic Health Record systems), accounting for varying EHR vendors and business processes.” — Hassan Sultan, Cedar CTO

Maven

“We were really lucky because Zach [Zaro, former CTO] called very early on the importance of the HIPAA compliance, privacy and data ownership issues. We actually built almost everything in-house, even our analytics platform where we track how members are using the app. … We built MPractice, which is our provider app, which has an EMR, … and we built the patient software which is the video appointments and scheduling. After we built the core telemedicine components, that was when we started building a personalized pregnancy program to drive healthy outcomes.” — Ryder (31:58, slightly edited for length and clarity)

Oscar

Oscar, initially focused purely on patient-facing products (consumer technology, plans, network contracts, customer support infrastructure) prior to open enrollment in 2014 (year after launch), and contracted insurance operations to external vendors. Over time, the company brought in operations in-house and built the tech infrastructure to support and optimize those operations, which now encompass the full-stack of health insurance.

In 2014: “It’s an interesting thing — we’re an insurance company, and we pay the claims, right? But there’s a next step, which is where we don’t just help you manage your health care but we guide you to care. And then there’s a third step, where maybe we provide some of the medical care ourselves. Maybe we set up our own MRI.” — Schlosser

Ro

“When we first started out, for example, we spent $300K of our $400K pre-seed round on building a pharmacy. A lot of people thought we were crazy to try and do that given the level of complexity — we bet the company we could”. — Reitano

“When we first started, we dreamt of the experience we wanted to deliver and worked backwards. This meant rebuilding the infrastructure from scratch. We built our own physician EMR, our own pharmacy software, patient application, and even our own pharmacy fulfillment center, which now power both Roman and Zero.” — Reitano (2018)

TrialSpark

Trialspark scaled up to being full end-to-end (being the trial site, CRO layer, and tech stack all in one) two years ago, four years after launch. [Liu — 19:36]

“In healthcare, there are often local optimizations that exist in the market that benefit incumbents, but subsequently create a macro-misalignment of incentives. Full-stack solutions can begin to align these incentives, creating drastically more efficient solutions. However, these solutions often take longer to implement so as a founder, it’s important to create a roadmap for your team to take a more ambitious, full-stack approach,” — Liu

“Because we own and operate the full-stack, we’re able to reimagine things like biostatistics. It’s one data layer, and you can imagine everything in a clinical trial is pre-specified. If all the data is structured in the right way, we can run interim analyses in a more scalable way with software.“ — Liu — 8:44

Optimize for scale at every point in tech / processes

A known conundrum in healthcare entrepreneurship is its lack of scalability. Human interaction is core to the healthcare experience,but human capital doesn’t scale. Patients, conditions, processes, data — all have a ton of variety and too few standardized best practices. The more revenue that a business with negative unit economics generates, the more money it loses.

To scale, you have to proactively build with scale in mind, and reactively adapt new learnings for scale. As you build for your area of focus, either identify the modular components of your tech / standardizable components of your processes, or design them into the core infrastructure of your end-to-end offering. What are the tech components, processes, resources, business relationships that are translatable towards net new efforts?

Then, as Alex Zhang, former Head of Product at Cedar, puts it,

It will inevitably be the case that there’s a line to be drawn between the limits of a quality, focused product and where a human experience should take over, whether it be to manage large enterprise clients, or to provide the human element of care, or anything in between. Automate manual processes, and where human interaction is necessary for patients, augment that interaction to its fullest extent (but more on that later).

Capsule

“So business is highly regulated and it is complicated to roll out the business geographically the way we are doing. Because we spent five years building this underlying technology platform, it’s lending us to accelerate the pace at which we do that because there’s a scalable system and technology platform under that.” — Kinariwala

Maven

“Though it was harder to raise funding in the early days when women’s health wasn’t a category, being one of the only companies in the space also gave us the opportunity to really focus on co-developing solutions with our early customers and building a foundation to serve the market at scale.” — Ryder

Oscar

“Perhaps most critically, we empower our business colleagues to perform semi-technical operations and control their own destiny. Flexibility, modularity and self-service are now the central themes driving our efforts. Key to these efforts is our own self-service configuration platform, which we call Automat.” — Sara Wajnberg, Oscar CPO

Ro

Ro utilizes its onboarding flow process, physician infrastructure, and pharmacy for every new condition it treats.

“While it might have looked like we were building a DTC ED company, we were building the core infrastructure to treat not just one, but hundreds of conditions via telemedicine.” — Reitano

Trialspark

“The operations of our industry are complex, filled with manual workflows and processes. We keep an eye out for automation in everything we do.” — Linhao Zhang, Trialspark CTO

Empower a relationship between your product and your patients

By optimizing your stack for scale, you increase your ability to reach more patients. But how do you deepen your ability to provide value to each individual patient? As mentioned earlier, all patient-facing healthcare converges to an engagement problem, and this is done through relationships.

It’s critical to recognize the role your product plays in your patient’s healthcare journey. Patients don’t view “products” in abstract, they are enduring emotional duress on top of their physical problems, and will view interactions with healthcare entities through an emotional lens. By earning their trust at each interaction, you earn continued engagement, and foster a deeper relationship that creates a personal experience.

Beyond standard engagement best practices, this is now what will be table stakes:

Branding / communication: The voice and perspective of your company needs to be one that resonates with empathy for the patient’s problems. Your messaging needs to be catered to the patient, meeting them where they are, personalized to their preferences.

Provider enablement: Every human interaction your patient has while using your service colors their view of the experience. So, these people are extensions of your product, and it becomes imperative for you to ensure that they can deliver the best experience possible. This is done through ensuring provider quality (through vetting or network design), absorbing administrative hurdles, clinical support, and/or financial incentives.

Long-term view: To quote Jay Parkinson, “telehealth is a feature, not a company.” This extends beyond telehealth. Your company isn’t the care or service you provide, but the overall experience. Building a relationship with your patients means being thoughtful about building an experience that considers long-term impact on patients, even when it creates short-term negatives. Doing right by your patients pays off.

Capsule

Brand: One of the three pillars Capsule was built around was creating an “emotional resonate brand”. As such, it emphasizes tracking brand resonance, consumer engagement via retention, and customer love; its third hire was a consumer brand expert; it has deployed unconventional marketing strategies such as taxi cab advertisements.

Providers: “Doctors across New York have adopted the tools we’ve built enabling us to provide real-time feedback loops to deliver better care than has ever been possible before.” — Kinariwala

Long-term: “Over the past year, our team has made thousands of calls to insurance companies to save our customers time. We’ve found and applied coupons that add up to millions of dollars in medication cost savings.” — Dr. Sonia Patel, Capsule Chief Pharmacist

On taxi-cab ads: “The out-of-home is super fun for us, and it’s really fun for the team. It makes our business come to life, and it makes it really tangible. It also happens to have the nice primary benefit of being highly effective for our business in creating credibility, awareness, and trust.” Kinariwala

Cedar

Brand / Communication: Cedar has invested heavily into its design and data science teams, who have conducted research projects with IDEO and FBI negotiators to develop a deeper understanding of different patient archetypes and the best ways to engage each one.

Providers: “The technology we deliver to providers gives them the ability to better communicate with patients and clearly see all the steps along the patient payment cycle. It was surprising to us when we started the company two years ago that a lot of hospital and health system leaders did not know their out-of-pocket collection rates or their times-to-collect. Moreover, they couldn’t break down this information by insurance, specialty, or location. Cedar offers all these functionalities, letting organizations drill down into the details and gauge performance.”- Otto

Long-term: Among its core features, Cedar offers customizable payment plans and data-driven discounting, and developed tools for claim denial and enabling Medicaid enrollment.

“For instance, Cedar communicates bill reminders via text message for relevant patients. In the short term, we could be tempted to increase the frequency of bill reminders via text messages because it leads to higher engagement, which in turn leads to higher collection and resolution rates. But this has a negative long-term effect: it creates high unsubscribe rates and an understandably negative patient experience; not having the option to text a patient has a negative impact on collecting future bills.” — Yohann Smadja, Cedar Head of Data Science

Maven

Brand: “Because healthcare is so personal, building a strong reputation of compassion, confidence, convenience, and quality ended up being the foundation for Maven’s success.” — Ryder

Providers: Maven’s extensive vetting process, (which was the first thing Maven built) accepts only 35% of providers. Maven providers are equipped through Maven’s M Practice app for administrative tasks.

Long-term: “Telemedicine was only used for a quick prescription or answer, without building a longitudinal patient-provider relationship. Maven’s platform is designed around this relationship.” — Ryder

“I also think that one of the most important things about building a new brand, but particularly in healthcare, is trust. And so how do you build trust with a new healthcare product? And I think having a very personalized network for women that’s built for women by women is one of the first ways to do that, so actually about 98% of our providers are women.” — Ryder

Oscar

Brand / communications: Oscar’s Concierge system was built for building patient trust at all touchpoints, and is empowered through in-house tools.

Providers: Oscar’s network construction process heavily leans on determining provider quality metrics and curating in-network providers accordingly. Oscar’s Clinical Dashboard “synthesizes a member’s health history, medical encounters, lab results, active and past prescriptions, hospital admits and discharge alerts, allergies, and more into a readable profile of a member’s current state of health.”

Long-term: Oscar has continually delivered in this regard, from providing fitness trackers for free and paying members for meeting step counts in 2014 to its recently announced free, unlimited Virtual Primary Care.

“We remind ourselves that a member’s trust is a delicate thing — earned with great difficulty and lost at the first sign of complexity or the impression that we don’t have their best interests at heart.” — Wajnberg

Ro

Brand: Ro’s launches into new verticals corresponded with the creation of new brands (Zero — addiction; Rory — women’s health), citing the need to “ speak to this community in a very different way than we speak to our current members.“

Providers: Ro provides clinical support and administrative lift (software maintenance, payment processing, background checks, provider credentialing, and malpractice insurance procurement.)

Long-term: Ro publicly takes pride in its cancelling workflow, and provides discounts for in-person PCP visits, along with unlimited communication, personalized treatment plans, and access to blood tests

“We built an amazing cancel flow. That’s right, Ro has the easiest way to delay or cancel a shipment in healthcare and we’re damn proud of it.” — Reitano

“How online visits, treatment plans, even their advertisements are written needs to make patients feel like Ro really understands them. When Ro can convey that, that’s how they build trust and eliminate the feeling of something being stigmatized.” — Dr. Melynda Barnes, Rory Clinical Director

Trialspark

Brand / communication: For its personalized patient outreach campaigns, Trialspark has utilized omni-channel communication approaches, digital / social media advertising, and partnerships, and employed creative designers for resonant branding.

Providers: Trialspark’s “site-in-a-box” model operates on creating standardized simplicity for its physicians, managing everything from payments and legal to logistics and data collection/analysis while also providing the necessary training and equipment.

“TrialSpark is uniquely positioned to be a consistent, guiding voice for patients throughout their clinical trial journey. From the very first time we meet a patient — perhaps before they are even looking for a trial — all the way through to FDA submission. We ask a lot from our patients: They are people that are struggling with conditions and symptoms that may not even have cures on the market yet. We’re asking them to volunteer months and years of their time and energy making visits to our sites. We’re asking them to share intimate details about their medical histories. In some cases, we’re asking patients to leave their current treatment options and switch onto a new, investigative one. It’s our duty and our privilege to partner with our patients and physicians to drive the future of medicine forward.” — Frank Wu, Trialspark SPM

A brief note

Easier said than done, but it’s so important to find proper product/market fit in this first area of focus prior to expanding to any new category. New products you build at any point prior to this will only be additional things to juggle on an unstable foundation, continually deteriorating your patient’s experience until they leave and take their (or their aggregator’s) money with them.