Healthcare's Passion Economy (Part 3)

Case studies of companies utilizing this Patient Aggregation Framework

This is Part 3 of a series. Here’s Part 1 and Part 2.

Healthcare Examples

Companies utilizing this framework are already emerging across distinct, complex healthcare verticals. Four examples I find intriguing are Honor, Unite Us, Headway, and Aledade.

Honor

Honor was among the cohort of mid-2010s companies that made waves trying to disrupt the home health industry through a Gig Economy model, along with HomeHero and HomeTeam. Difficulties stemming from changing regulatory environments, operational and supply acquisition challenges, and tying into healthcare incumbent contracts and workflows resulted in a tumultuous journey for all three. CEO Kyle Hill’s post-mortem after the cease of operations of HomeHero is now famous, while HomeTeam underwent an organizational overhaul and has rebranded as Vesta Healthcare.

Honor experienced similar road bumps as a DTC home care organization, before announcing with their Series C a pivot into a partnership-led strategy. Naming it the Honor Care Network, Honor leaned into establishing partnerships with independent home care agencies and aging services entities like senior living communities, after noticing the fragmentation and clear pain points of these independent operators. Marketed growth success and new large fundraising rounds indicate a more sustainable model.

“The core opportunity Honor has really seen is that there’s a very high degree of fragmentation in the current home care market, and that does create a lot of challenges for clients to navigate, for [caregivers] to get vested, so we’ve had a very, you know, relatively simple mission — to create a national platform to address a lot of those issues that fragmentation has created.” - Nita Sommers, President

Framework Alignment:

Business Model

Partners with fragmented independent home care agencies, aging services entities (senior living communities), in exchange for a negotiated share of agency revenue.

Agencies stay independent, but agree to co-brand with Honor

Offerings

Provides tech-enabled operational lift for back-office functions: billing, payroll, legal and regulatory, compliance.

Improves caregiver turnover rates (key agency pain point): caregiver recruitment, evaluation, onboarding, retention, scheduling, added staffing, training

Improves client experience through augmenting with nationally-scaled data insights and technology: ex. Decreasing caregiver churn by improving on experience variables (such as travel distance)

Enables agency growth through support in digital marketing, sales team training

Business / Industry Impact

Enhanced delivery of localized experiences: “The locally-owned agency providers in Dallas, Los Angeles, and Albuquerque understood their communities better than we ever could. Not just cultural nuances, they knew the health and social support systems for older folks, who families turned to when looking for a caregiver, and the key institutions within the community who helped their patients and clients find quality home care. And they had spent years building real relationships and real trust, which is what this business is about.” - CEO Seth Sternberg

Enhanced delivery of personalized experiences: “They ran local, home-grown businesses—all deeply embedded and respected in their community—and it resulted in a deep kind of personalization that technology alone could never replicate.”

Industry-leading caregiver retention: 82% industry caregiver turnover vs 36% for Honor

Accelerated scale for Honor: Within a year post-pivot, Honor tripled hours of providing client service, and doubled market coverage, while receiving inbound agency interest.

Criticism - Honor has received questions and public criticism about the occasionally aggressive revenue share it arranges with agencies and recent corporate turnover (which may not necessarily be due to the strategy shift).

Next Moves

Honor intends to utilize the leverage of its scale to develop a national set of standards for home care and contracts with large scale insurance carriers / major health systems.

“It is currently not possible for a national insurance company or hospital chain to work with one single home care provider across markets to provide a consistent experience. We believe Honor can change that – with our technology and operational capabilities, it’s extremely do-able for us to provide a consistent, high-quality service across all markets we serve” - Sommers

Unite Us

As veterans, co-founders Dan Brillman and Taylor Justice both experienced the pain points and inefficiencies of care transitions between healthcare and social services, and founded Unite Us in 2013, originally focusing on aiding veterans in utilizing VA services.

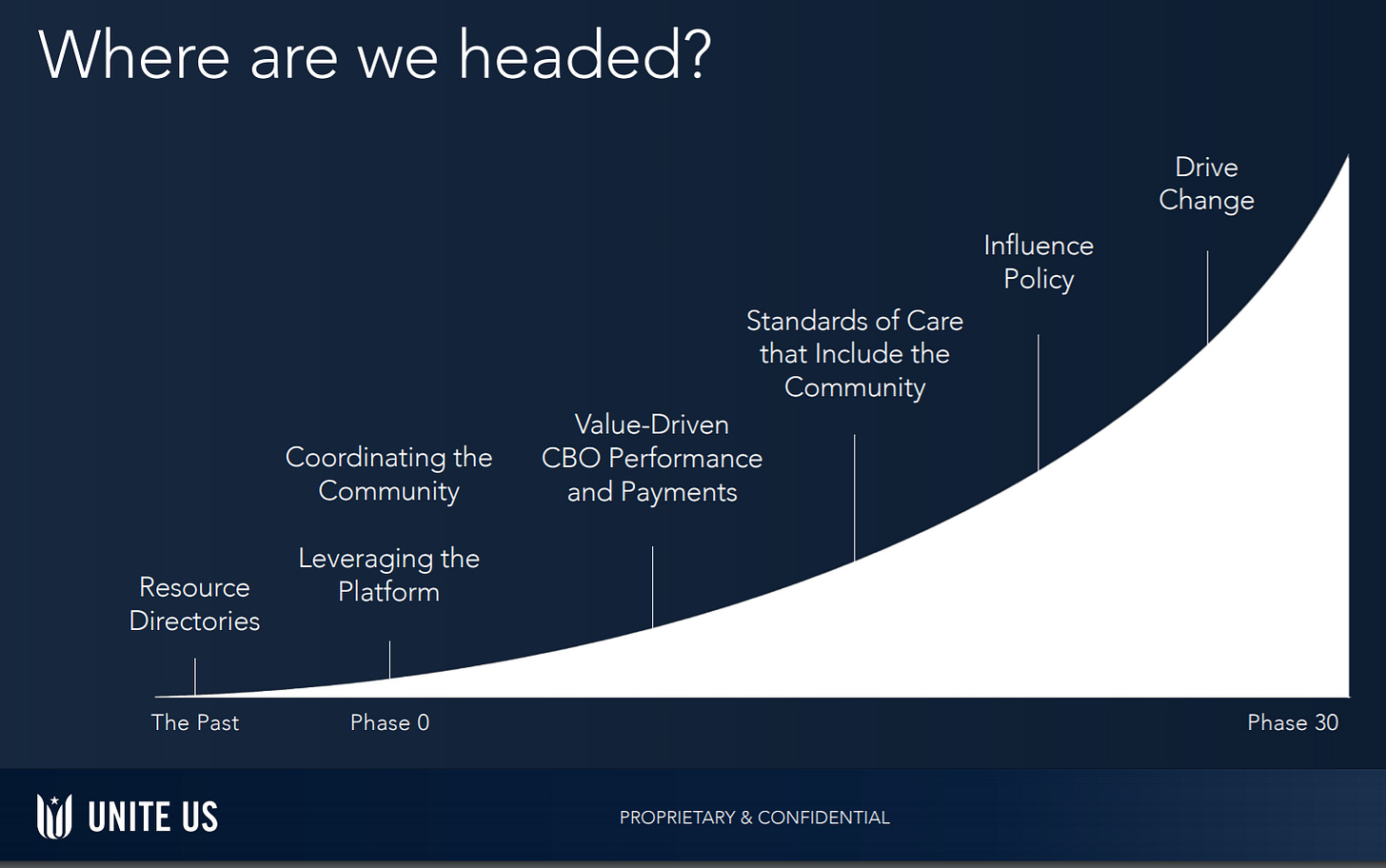

With social determinants of health (SDOH) being an emerging market at the time, Unite Us went through early challenges and pivots. Initially, it provided a resource directory, but Brillman and Justice found that the lack of coordination and accountability among community based organizations (CBOs) resulted in patient dropoff and poor visibility into outcomes. Largely, this was due to CBOs being under-resourced and underfunded while having to utilize antiquated manual processes.

This realization fueled a pivot into a more deeply integrated solution. Brillman and Justice took a year to develop a framework around where CBOs aligned on SDOH outcome standards, then incorporated that framework into developing a tech-enabled CBO referral network that tracks those outcomes. Key to a sustainable network was building relationships with these CBOs and creating value for them. They then offered health systems access to outcomes data and access to this CBO network. Finding success through this pivot, Unite Us has now expanded to serve Medicaid, Medicare and commercial patients as well.

“80 percent of someone's overall health happens in the community and not in a clinical setting. How do we then bring that into that person's overarching health picture? And so as we start to create those work streams and you create value for the health care system to reduce costs and engage with these community based organizations, we then had to create solutions in the back office for the CBO to submit invoices and so make claims back for those services. So we become this marketplace where health care, community based organizations are not only working together, but they're in a business relationship together as well. And the whole goal is to improve health, not just health care, but health.” - Taylor Justice, CBO/Co-Founder

Framework Alignment

Business Model

Works with local CBOs to construct coordinated social care networks

Offerings

Provides health systems with integrated software to securely coordinate with CBOs and track/analyze SDOH outcome data

Builds and curates tech-enabled SDOH care coordination networks within communities by deploying localized implementation teams that onboard and train CBO service providers that understand local dynamics

Provides these network service providers with software for screening / risk stratification, referral management, care plan management, intranetwork communication, bidirectional communication back into health systems, outcome data tracking, and longitudinal service data

Provides onboarding, training, implementation, tech-enabled process efficiencies, and support to service providers

Facilitates CBO reimbursement workflows for health systems

Business Impact

Scaled patient distribution: Unite Us has coverage of more than 21 million patients as the largest social services network operator across 20+ states and active networks in 42 states

Enhanced local navigation: Unite Us networks saw a 93% reduction in average time to referral acceptance across all service types (utility payment assistance, food access, transportation, etc.) since 2014.

Improved CBO partner efficiencies: “Some organizations are seeing an 85 percent drop, which is saving 15 hours per employee per week.” - Justice

Success with larger payers and health systems: Improved 50% of KLAS-surveyed Unite Us customers said that they saw outcomes immediately, and 30% said that they saw outcomes within six months or less. This has led to partnerships with Aetna, Humana, and other major insurers

Next Moves

In the short-term, Unite Us sees data interoperability anad enhancing its own integration capabilities as a core initiative, likely seeking to further develop standards around SDOH data sharing.

Long term, Unite Us plans to utilize those standards to leverage tighter inclusion of CBOs and SDOH into value based care and the overall healthcare supply chain.

Headway

After struggling to find a therapist that accepts his insurance, CEO Andrew Adams learned that this was an indicator of a larger problem: the process for a therapist to accept insurance is extremely tenuous, leading to 70% of therapists not accepting new patients on insurance. Many practices (solo or group) do not have the bandwidth to navigate the bureaucracy of health insurance, an activity which often takes up entire billing and administration departments for larger hospital systems. Headway started under the thesis that making accepting insurance easier for therapists would increase therapist ability to take on patients, subsequently increasing patient access to therapy.

“Health insurance is built around a medical world dominated by billers and admins, but therapists are small practitioners and don’t have the bandwidth to handle that, so they don’t. So we thought if we could make it easier for them to, they would, and they have.” - CEO Andrew Adams

Framework Alignment

Business Model

Provides software and services to patients and licensed, practicing therapists for free

Takes commission from insurance carriers who pay for access to and patient engagement with a broader network of therapists

(Headway is able to profit more from insurance commissions by automating away standard overhead needs)

Offerings

Provides tech-enabled operational lift: insurance administration process automation (key therapist pain point), claims processing, payment processing, scheduling, billing

Improves experience through therapist-centric EMR

Enables practice growth through marketplace with localized, personalized demand-supply matching (variables like ZIP code, specialization, etc.) and digital marketing

Business Impact

Improved patient access: As of November 2020, Headway was working with ~1800 therapists in NYC, of whom two-thirds were only accepting insurance through the company. (Number is now 3107 in multiple markets, and this makes it the largest group practice in the country). These therapists are serving “tens of thousands” of patients at an average savings of 81% per appointment.

Improved patient retention: Headway advertises 90% retention and 93 NPS, both of which are industry-leading numbers.

Next Moves

As an earlier company, Headway is exploring supply growth through primary care referrals and partnerships with enterprise companies as a benefit.

Aledade

Well established in healthcare, Dr. Farzad Mostashari served as the national coordinator for health IT in the U.S. Department of Health and Human Services during the Obama Administration. During the development of the Affordable Care Act, the concept of the accountable care organization (ACO), where primary care providers coordinate between each other under a value-based payment model began to crystallize. After his tenure as national coordinator, Dr. Mostashari spent time at the Brookings Institute formulating the ideas for what would eventually become Aledade, using the ACO as the backbone of the model.

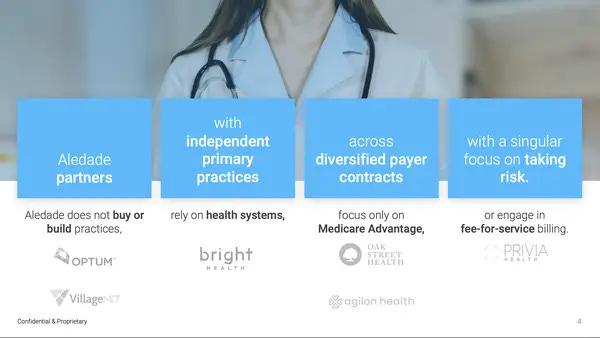

“We are different in that we have delivered results at scale across over a dozen different markets using our tech-enabled playbook. We don’t deliver care ourselves, we support those who do. We don’t buy practices. We empower them.” - Dr. Farzad Mostashari, CEO

Framework Alignment

Business Model Model Source

Unlike other primary care companies like One Medical, Oak Street, or Iora Health, Aledade doesn’t build brick-and-mortar clinics or provide care itself; it constructs ACOs out of independent primary care practices, then facilitates value-based care contracts between them and Medicare / commercial insurers and provides necessary product and services to ensure the success of these contracts.

Aledade shares the capitated payments with practices (where providers are paid a fixed amount by insurers for care, and can keep the medical cost savings). For every $1000 savings generated for health plans, $400-$750 is split between Aledade and physician partners.

Offerings

Provides resources, expertise, process installations, legal/regulatory support, and scale needed for primary care practices to join ACOs and take on value-based risk.

Integrates with EHR data, hospital discharge data, claims data, lab and pharmacy data

Drives better care through insights on proactive outreach for algorithmically identified high-risk patients, point of care suggestions, follow-ups, and care coordination.

Business Impact

Accelerated scale: In its pitch deck, Aledade reported 15x in growth of medical spend under management over the last 5 years. The company works with 7800 providers (with 84% DAU!) at 800 practices to provide care to 1.2 million patients. During the early stages of COVID-19, Aledade launched telehealth capabilities for 150 practices over a weekend.

Business growth for Aledade and primary care practice partners: As of January 2021, Aleade’s practices have earned $115 million in capitation payments, while Aledade itself reached profitability in 2020. (In comparison, competitor One Medical sees continued losses, and saw net losses climb with increasing patient membership during certain periods.)

Positive care outcomes: Patients at Aledade’s participating practices experienced 20% increase in primary care utilization, 14% decrease in ER utilization, 15% decrease in inpatient utilization, and 22% decrease in skilled nursing utilization

Future State

Aledade’s focus with its most recent raise will be pursuing strategic partnerships with Medicare Advantage plans. Over 2020, it had already doubled patients served in MA contracts to 100,000, but this is still less than 10% of their patients under management.

It seeks to launch initiatives into overall population health: integrated telehealth, prevention of unplanned dialysis, reduction of racial disparities in hypertension control, etc.

Aledade also will aim to enable the long tail of primary care practices to join ACOs through it.

Here are some more companies that I think fit this mold to some extent:

Special thanks to Nikhil Krishnan, Andrew Pajela, Chris Hogg, Alex Zhang, Neal Khosla, and Byron Edwards for helping workshop this. Candidly, this series was a whole mess before their feedback :)

Please feel free to leave comments or questions, and don’t hesitate to reach out to connect or collaborate!