Data — The Core Bottleneck to Digital Health (Part 1)

Healthcare industry’s data problems impede healthtech innovation. Who are the main stakeholders, and what are the main trends?

This post was originally published on Medium.

This is Part 1 of a series. Here’s the Overview, Part 2, Part 3, Part 4 and Part 5.

The current healthcare landscape.

Let’s level-set on the healthcare landscape. The three major stakeholders that are consistently influencing the dynamics of healthcare are patients, providers, and payers. Overall, the power dynamics of healthcare is shifting to the patient, and providers and payers are feeling more pressure than ever to accommodate patient demands.

Patients:

Patient access to care is rapidly diminishing as the pandemic makes known issues in healthcare more pressing than ever. The impact of social determinants of healthcare is a growing threat, as lower-income communities are hit harder. This population is growing — jobless claims have spiked, reducing income levels of millions of families. Meanwhile, healthcare providers were already in shortage, but this is exacerbated by COVID-19. Additionally, operating in close proximity to each other, providers are even more in danger from contaminating each other.

The percentage of persons under 65 enrolled in a high-deductible health plan (graph below) has steadily increased. Meanwhile, the increasing costs of American healthcare are eventually passed down to the consumer as 17.8% of premiums go to operating costs. These factors combined (along with a large uninsured population) means consumers are increasingly paying more out-of-pocket (OOP) for their health.

The historic lack of transparency and competition between health systems have uncoupled quality of care from its cost.

The above, combined with the fragmentation of the healthcare experience has meant that the patient is playing darts blindfolded, hoping to hit the bulls-eye of a healthcare experience that meets their needs. This could mean coordinating their care (potentially between multiple specialties), understanding the complexities around insurance and billing, all the while managing disruption in their lives and the difficulties of their healthcare needs. As the system gets more complicated, the individual patient finds it less valuable (while paying the same or more).

The patient population is becoming increasingly digital-native. 60% of consumers expect their healthcare digital experience to mirror that of retail, and expectations for healthcare to be personalized and accessible are growing.

Patients pay with their feet towards the healthcare experience with the best price, quality, and convenience. (check out this video with Ro CEO Zach Reitano for more detail)

Providers and health systems:

Tremendous costs from administrative waste ($265.5B), pricing failure ($240.5B), failure of care delivery ($165.7B), overtreatment / low-value care ($101.2B), fraud and abuse ($83.9B), failure of care coordination ($78.2B), among other things, cripple health systems and also payers. 20–25% of healthcare spending is wasteful — as seen in the chart below, even despite the high spend, the US leads its peers in preventable deaths.

Source: Mary Meeker’s 2019 Report

Physician burnout from administrative bureaucracy and high stress, though recently decreasing, is a prominent threat to healthcare and directly affects cost and patient outcomes. Clinicians spend 5.9 hours of their 11.4 hour work-days on EHR and administration related tasks.

Instead of innovating to solve inefficiencies, health systems uses the unscalable approach of throwing bodies at the problem (see graph), exacerbating costs year-over-year.

Meanwhile, median operating margins for hospitals are razor-thin [source] at 1.7% in 2018, meaning healthcare executives have to overturn every stone to unearth every last pebble of profit.

The increase in OOP costs for patients has led to increased leverage for the patient population — patients have the potential to affect 61% of all healthcare spending. Though a consumerized experience was previously just a strong desire in the healthcare industry, it has now become table stakes for health systems [#2 for healthcare execs]

PR / moral nightmares, such as surprise billing and harmful, aggressive collections tactics, sour the reputation of hospitals in the consumers’ eyes.

The Affordable Care Act created guidelines around the first value-based care (VBC) model, which ties payment of care to value to the patient as opposed to volume of services. Since then, the adoption of VBC models and people covered under such contracts is steadily increasing, which means that health systems revenues will be increasingly tied to patient outcomes. This has in turn increased provider attention and scrutiny in population health, coordination of care, and improved understanding of quality.

Payers:

Functioning as an aggregator of consumers’ purchasing power and mediating patient-provider interaction, payers have historically been the ones with the most influence on the healthcare system. Unfortunately, as Sidney Primas notes, payers have also been incentivized to increase the cost of medical care over time for profit.

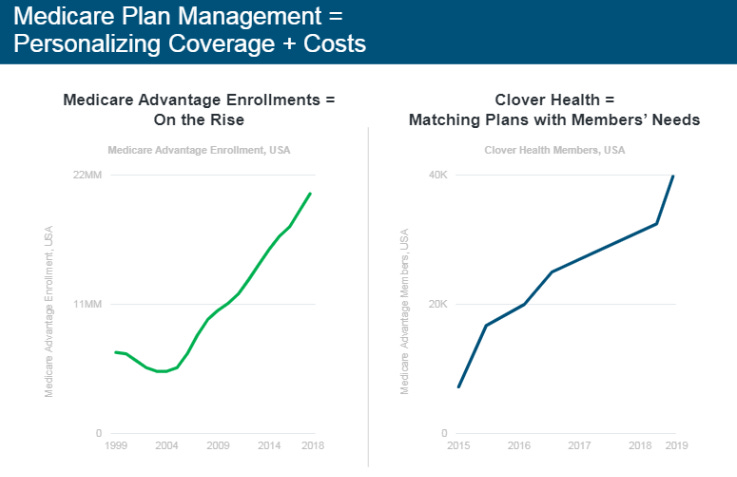

However, tides are shifting in healthcare — just like with health systems, patients are gaining leverage and are increasingly demanding a consumerized insurance experience. The trend of increasing enrollments in Medicare Advantage adds to this effect. There’s a lot of ground to make up here, as health insurance companies ranked in the bottom five of industries in customer satisfaction, lower than airlines.

New insurance startups are riding the tides of these trends to threaten incumbents. Clover (see graph from Mary Meeker’s 2019 Report below), gained market share through personalizing healthcare plans to the needs of members. Oscar utilized a deeply personalized and engaging patient experience en route to a $3B valuation. (As Nisarg Patel cites in his insightful dive into Oscar, “41% of [Oscar’s] members are monthly active users. Compare that with telemedicine market leader Teladoc, where only 2–3% of its members use the service annually”)

Payers also suffer from the costs of inefficiency mentioned above for health systems (spending almost $250B of excess a year on administrative issues such as eligibility processes, coordinating reimbursement, and handling claims). To optimize margins, they are driven towards investing in methods to deliver improvements to enhanced patient experience/outcome and reduction of administrative and medical cost.

In particular, VBC has proven more cost effective in providing better patient outcomes compared to fee-for-service plans, according to a Humana report. This has led to a need for tighter collaboration between payers and providers, and formalized partnerships between the two stakeholders (such as accountable care organizations (ACOs), 50–50 joint ventures) are gaining in number.

Payers are recently turning their eyes towards startups as they now “need to differentiate in a stagnant commercial market and compete,” note Venrock partners Bob Kocher and Bryan Roberts.

In sum:

If they can even access care in the first place, patients are using larger shares of their income to pay for a healthcare experience that is unnavigable and broken, so they need the right tools to better navigate their care and have improved. outcomes. However, this also means patients have increased leverage.

Health systems need to meet patient demands and improve outcomes to optimize margins as costs related to burnout, waste, and inefficient processes pile up to staggering amounts.

Formerly at the top of the healthcare pyramid, payers now face an existential threat as patients command more leverage and the attention of new healthcare entrants/competitors. They too need to innovate through personalized patient experiences, tech-enabled services, and process efficiencies to differentiate in a much more competitive market.

Value-based care initiatives are driving payer-provider partnerships in which each focus on respective strengths in order to create a differentiated consumer experience. This in turn requires tighter collaboration between the two stakeholders.

Next, let’s learn about the emergence of digital health as an attempt to resolve these problems. Click here for Part 2.